How To Cash My Bitcoin

Bitcoins investment is one of the riskiest yet there are high profits included. ‘

Different Ways to Cash Out Bitcoins into Cash or Bank Account

The simple way to sell or cash out Bitcoins is to sell them via some websites which are quite famous and reliable in their business.

1. LocalBitcoins

Sell Bitcoin and Bitcoin Cash easily The easiest way to cash out your Bitcoin and Bitcoin Cash directly to your bank account. Currently available for EU and GBP bank accounts. Join the waiting list to be one of the first to know when support will be available for your region. It is hard to go wrong with this site. It is one of the most popular sites on the web for.

Press Withdraw Bitcoin. Scan a QR code address or press Use Wallet Address to enter one manually. Confirm with your PIN or Touch ID. You must have a balance of at least 0.0001 bitcoin to make a withdrawal. You can withdraw up to $2,000 worth of bitcoin. The single best way to cash out large amounts of Bitcoin is through something called an OTC (over-the-counter) transaction. An OTC transaction occurs when a private buyer and private seller are linked together by an intermediary to facilitate the swap.

On this website, you can sell Bitcoins in two ways- through online bank transaction or in hand transfer. You need to sign up and add the Bitcoins which you are willing to sell. You can prefer to sell for direct cash/ or bank transfer. People around you could see the price which you are quoting and can approach you. Since LocalBitcoins doesn’t verify the users beware of fraudsters as people you meet can harm you and may not be trustworthy. Localbitcoins connect the purchaser and seller personally where the Bitcoin can be converted to cash without any taxes or banking charges. Visit LocalBitcoins.

2. Bitquick

Bitquick is a platform where you can sell Bitcoins at the current price without any commission and is one of the fastest exchange. They provide a simple procedure where the user needs to enter the amount of Bitcoin on the personalized escrow address. There are various option to sell Bitcoin at such as static pricing and dynamic pricing. Dynamic pricing allows you to select the Bitcoin exchange rates and time of Bitcoin pricing. Such as 24hrs average, current price, whichever is greater. The amount would be directly sent to your bank from where you can withdraw the cash. Bitquick is not a secure website though, which may tamper your credentials. Visit Bitquick.

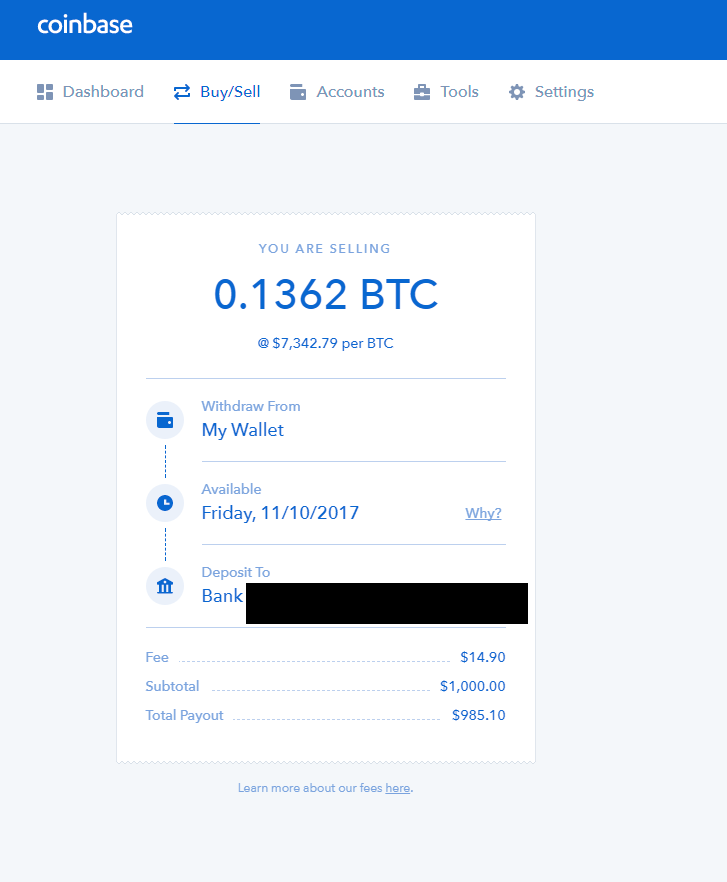

3. Coinbase

This is a trustworthy, safe place where you can sell Bitcoins for a reasonable price. Even though they levy a percentage of commission yet it is safe without any risks. You can go the wallet and select the number of Bitcoins you intend to sell. Once you confirm the amount would be sent to your bank which is being registered on Coinbase. Visit Coinbase.

4. CEX.io

Cex.io allows you to cash out the bitcoins in two different forms- bank transfer and cryptocurrency. This can be used for further investment or can be used to cash out. Cex.io is trustworthy exchange located in London. They require ID verification and valid proofs in order to make a transaction with them. Visit CEX.io.

5. Peer-to-Peer trading

This method of Bitcoin to cash includes a Bitcoin space such as Brawker or Purse where I would put my Amazon request regarding some household or personal purchase and the final cheque would be paid by a random stranger through his credit/debit card. Once the package reaches my place the Bitcoin space would pay the stranger in appropriate Bitcoins. In this way, the products which we need can be bought for Bitcoins. Bonus Tip:

How to Cash Out BTC in the Local Market

In most of the countries, people are waiting to buy and invest on Bitcoin without using a bank account. Some do that to save the tax amount while some do it for illegal purposes without producing any documents/credentials. In fact most of the people with black money these days prefer using Bitcoins for converting their black money, in countries like India, people end up paying 10-15% more than the actual Indian Bitcoin value just for a cash purchase. This method is both cheaper and riskier than other markets. If any of our friend, family or relative is holding a Bitcoin and are willing to sell then you can get the Bitcoin at the actual price i.e. 15-30% less than the Indian value. By that way, you can make an in hand transaction without paying any commission to Bitcoin exchanges or paying tax to the government. The liquidity of Bitcoin can be maintained by these way where you can save yourself from bearing a loss. Converting to hard cash is always slightly difficult and risky while you can convert it into the bank account or other cryptocurrencies easily. There are some websites such as Coin.ph where you can invest on Bitcoins and can take it back to the Coin.ph wallet where it is safe and secure. It can be reused to either invest or can be reverted back to the bank account.

© R.Tsubin/Getty Images Although used as a currency, Bitcoin is taxed like an investment, and you might be liable for any profits made when you sell or spend it. R.Tsubin/Getty Images- The IRS considers Bitcoin to be property rather than money, so transactions are subject to the same tax treatment as other investments.

- Bitcoin taxes can be triggered by trading, exchanging, or simply spending the cryptocurrency, so documenting everything is essential.

- Bitcoin is taxed at the special capital gains tax rate, which is often less than the ordinary income tax rate.

Bitcoin seems to be everywhere these days. From its mysterious origins in 2008, it has grown into a widely accepted currency, used for everything from investing to shopping to employees' wages.

But many Bitcoin users don't realize that buying/selling, exchanging, and even using Bitcoin to pay for things has tax implications. Yes, you read that last phrase right. In some cases, just spending your Bitcoin could be considered a profitable investment - and taxable.

From how exactly it's taxed to how to prepare for filing, here's what you need to know about Bitcoin taxes.

How Bitcoin is taxed

Bitcoin and its comrade cryptocurrencies (Ethereum, Ripple, Tether, and Litecoin) appeal to users because they are secure and provide a degree of anonymity. It's that anonymity, along with the growing value of cryptocurrency transactions taking place worldwide, that has increasingly drawn attention from the Internal Revenue Service (IRS) in recent years.

Since you can use Bitcoin and other cryptocurrencies for everything from online shopping to donating to charity, you might assume the IRS treats cryptocurrency like cash. That assumption can get you into hot water.

According to IRS Notice 2014-21, the IRS classifies cryptocurrencies as property, not cash or currency. That means it treats Bitcoin transactions like sales of stocks and other investments. Purchasing cryptocurrency with cash and holding on to it isn't a taxable transaction, but selling, exchanging, or using it to purchase goods and services is.

For example, say you purchase 10 crypto coins for $10 (basically, $1 apiece) on December 1, 2020, and load them onto a cryptocurrency debit card. On December 20, 2020, that cryptocurrency is trading for $5 per coin, up from the $1 per coin you paid for it back at the beginning of December. On that day, you use your cryptocurrency debit card to pay for a $5 cup of coffee.

On your 2021 tax return, you are supposed to report a $4 short-term capital gain ('short-term' because it happened within one year). That's the $5 per coin value you received when you purchased the cup of coffee, minus your $1 per-coin basis (what you paid for it) in the cryptocurrency.

That's a level of record keeping that few taxpayers are willing to keep up with - if they're aware of the requirement at all.

Why is Bitcoin taxed?

According to a survey conducted by The Harris Poll on behalf of Blockchain Capital, roughly 9% of American adults own Bitcoin. However, the IRS estimates that only a tiny percentage of them report crypto-related gains and losses on their tax returns.

In 2017, the IRS searched its database for the 2013 through 2015 tax years. It found:

- 807 individuals reported cryptocurrency transactions in 2013

- 893 individuals reported cryptocurrency transactions in 2014

- 802 individuals reported cryptocurrency transactions in 2015

That discrepancy is why the IRS is making cryptocurrency taxes an enforcement priority in 2021. In fact, Form 1040 for the 2020 tax year includes a question about cryptocurrency on the front page. It asks whether you've received, sold, sent, exchanged or otherwise acquired a financial interest in any virtual currency.

If you check 'no' to this question when you did, in fact, engage in cryptocurrency transactions, the IRS can consider that a willful attempt to avoid taxes, and you could face harsher penalties if the IRS uncovers your omission.

How to prepare and report Bitcoin tax filing

The IRS taxes Bitcoin as an investment. That means it's subject to the same tax rate of capital gains and losses that other financial assets are subject to when you sell any holdings in it, realizing a profit or loss.

Video: Taxing Bitcoin: The IRS wants people to disclose virtual currency activity (CNBC)

Step 1: Gather information for Bitcoin tax reporting

For each transaction, you need to know the following:

- The amount (in dollars) you spent to buy the cryptocurrency

- The date you purchased (or received) them

- The date you sold or exchanged the coins

- The amount in dollars the cryptocurrency was worth when you sold it (or value you received in the exchange)

When you sell stocks, at the end of the year, your broker will send you a Form 1099-B that includes all of the necessary information to report those sales on your tax return. But don't expect the same service from a cryptocurrency exchange. Most crypto exchanges only send 1099 forms to customers with gross payments over $20,000 or more than 200 cryptocurrency transactions during the year.

However, you can typically generate reports through your cryptocurrency exchange platform that will include all buys, sells, sends, and receipts of cryptocurrency from the account. If all of your cryptocurrency transactions take place on one exchange, gathering the information you need for tax reporting should be relatively easy. If your cryptocurrencies are scattered across several exchanges, you'll need to download separate reports from each of them.

Step 2: Calculate your Bitcoin gains and losses

Once you have all of the information on your cryptocurrency activity during the year, you need to determine whether you incurred a gain or loss on each transaction. To do this, you'll need to decide which method you'll use to value the cryptocurrencies you sell. Your options are:

How To Cash In My Bitcoin

- First-in-first-out (FIFO). The coins you purchase first are the ones you sell first.

- Specific identification. You select which coins you're disposing of in each transaction.

The method you choose can greatly impact the amount of taxes you end up owing in a particular year.

Say you purchase 100 crypto coins for $1 each on January 1, 2021, and another 100 coins for $20 each on June 1, 2021. On February 1 of the following year, you sell 40 coins for $15 each.

Using the FIFO method assumes the 40 coins sold came from the January 2021 lot. As a result, you would have a long-term gain of $560. That's 40 coins at $15 each less 40 coins at $1 each, or $600 - $40 = $560.

Using the specific identification method, you could decide that the four coins sold in February of 2022 came from the lot purchased in June of 2021. In that case, you would have a short-term loss of $200. That's 40 coins at $15 each less 40 coins at $20 each, or $600 - $800 = -$200.

Some cryptocurrency exchanges provide a gain/loss report. However, these reports are typically only provided on the FIFO method, so you won't be able to benefit from using the specific identification method if you rely on them.

Step 3: Report your Bitcoin transactions

Capital gain transactions are reported on IRS Form 8949. The form is divided into two sections:

How To Claim My Bitcoin Cash

- Cryptocurrencies held for one year or less go in the short-term section. Short-term gains are taxed at the same rates as ordinary income, with the top rate being 37%.

- Cryptocurrencies held for longer than one year go in the long-term section. Long-term gains qualify for more favorable long-term capital gains rates, which cap out at 20%.

Include your totals from Form 8949. If you sold other non-crypto investments, report those on a separate Form 8949. Carry the totals from all 8949 forms to IRS Schedule D.

The financial takeaway

You might have figured that investing in Bitcoin could have tax implications, especially if you make a profit on it. But it might surprise you to know that just spending your Bitcoin could trigger that taxable profit.

Purchasing cryptocurrency with cash and holding on to it isn't a taxable transaction, but selling, exchanging, or using it to purchase goods and services is.

Tracking the ins and outs of cryptocurrency transactions can be challenging. If you own cryptocurrency and have many transactions, it's a good idea to talk to a CPA or other tax professional familiar with cryptocurrency tax reporting. They may be able to recommend software to help track transactions and ensure you're properly accounting for them on your tax return.